Many consumer products (CP) company CEOs are hesitant to pursue M&A as they try to assess which consumer behavior changes prompted by the pandemic will stick. But that hesitancy could result in missed opportunities, as our research shows that companies that actively pursue M&A deliver higher total shareholder returns (TSR).

Companies that proactively evolve their portfolio through acquisitions and divestments now and into 2022 may be best positioned to engage consumers digitally through direct-to-consumer (DTC) channels. They may also be well-positioned to add digital tools, such as artificial intelligence (AI), to make their supply chain management more flexible and offer innovative new products and services as the pandemic continues to affect where and how consumers spend their time.

M&A deals have rebounded, but executives remain cautious

Deal activity paused early in the pandemic, and total deal volume in the CP industry fell about 25% in 2020 from the prior year1. However, the pace picked up in the fourth quarter, with 35 deals of more than $10 million announced, including larger deals such as Inspire Brands’ $12.3 billion acquisition of Dunkin Brands and VF Corp’s $2.4 billion acquisition of Supreme Holdings2. Packaged food, personal care and home improvement companies were highly active, with digitization a common theme across deals.

Several factors support continued momentum through 2021: companies with strong balance sheets are looking to drive their growth agenda; the pandemic highlighted the need to accelerate digital transformation; private equity and venture capital firms entered the year with about $750 billion in dry powder to deploy.

Yet, according to the EY Global Capital Confidence Barometer, only 39% of consumer products executives say they will be actively pursuing M&A in the next 12 months — 10 percentage points lower than respondents’ intentions across sectors.

Waiting can be costly

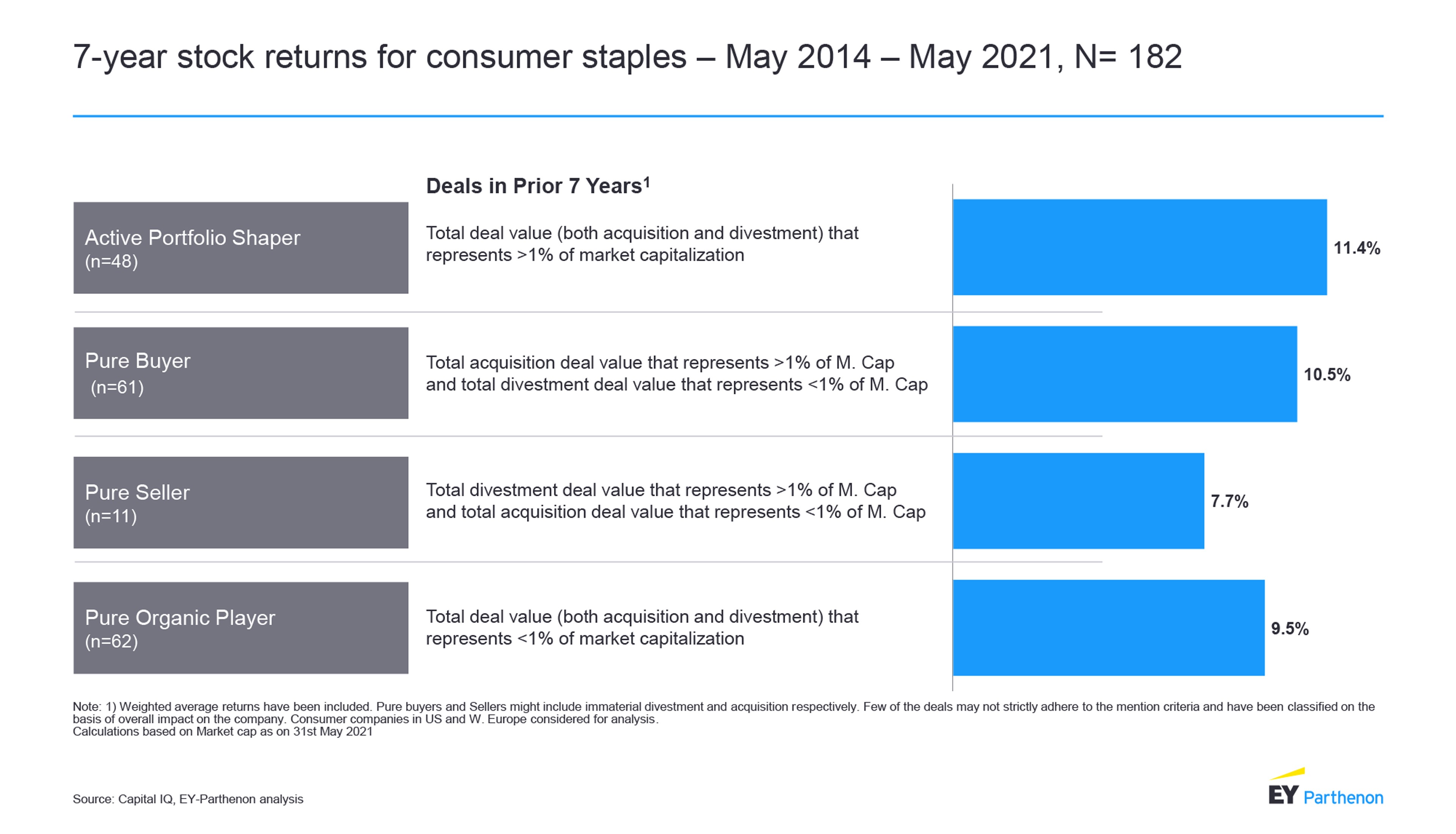

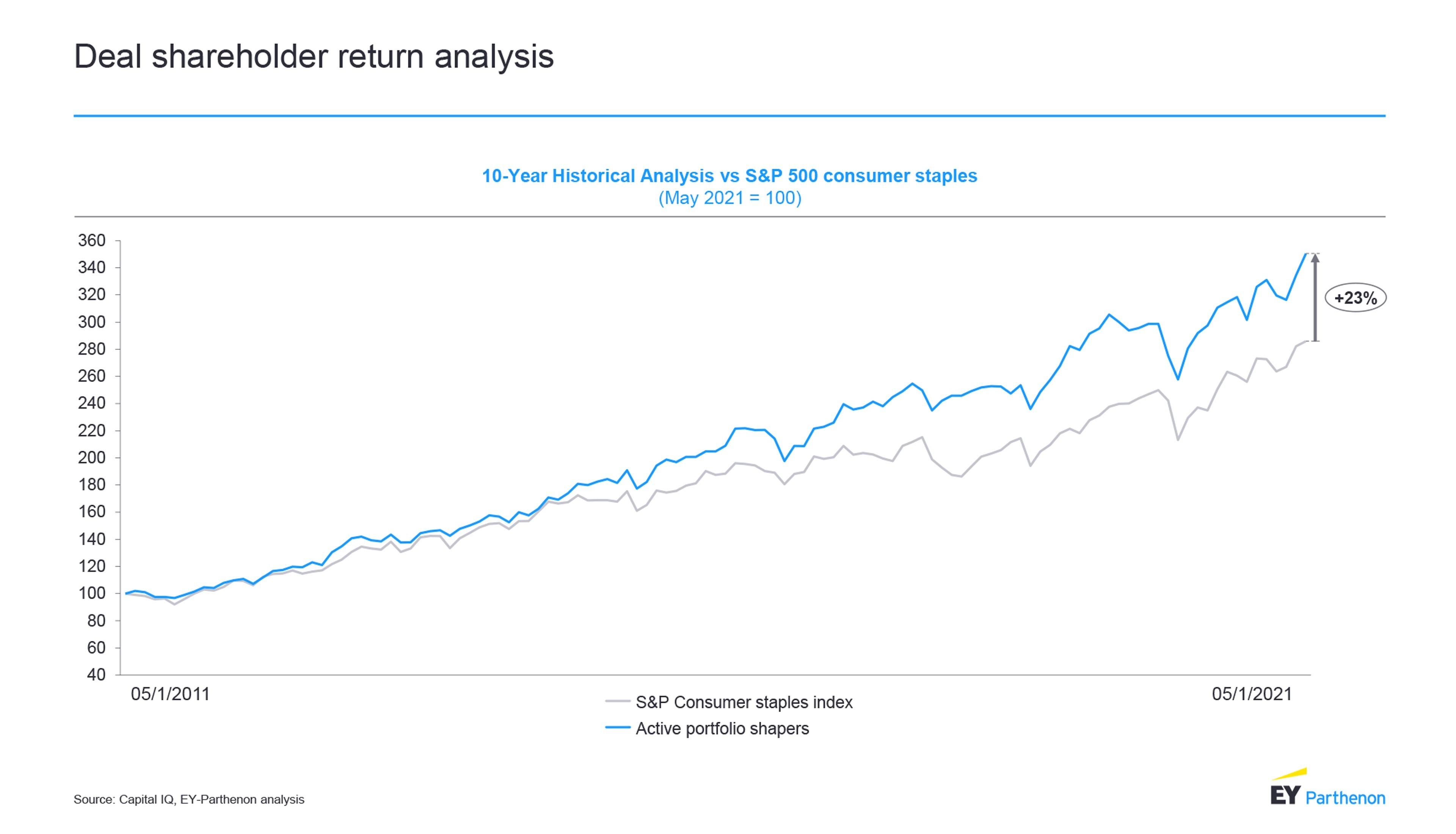

Hesitancy could prove costly. An EY-Parthenon analysis of Capital IQ data (Figure 1) shows that active portfolio shapers (companies with total deal value in the last seven years that represents >1% of market capitalization) delivered almost 150bps higher shareholder returns for each year over the last seven years, compared to companies focusing on organic growth (companies with total deal value in last seven years that represents <1% of market capitalization).